I want to break down a framework every business owner should know: the four stages of company growth and how they directly impact what your business is worth — and whether you can actually sell it.

This model, originally laid out by Scott at BSG, is a simple but powerful lens on the private market:

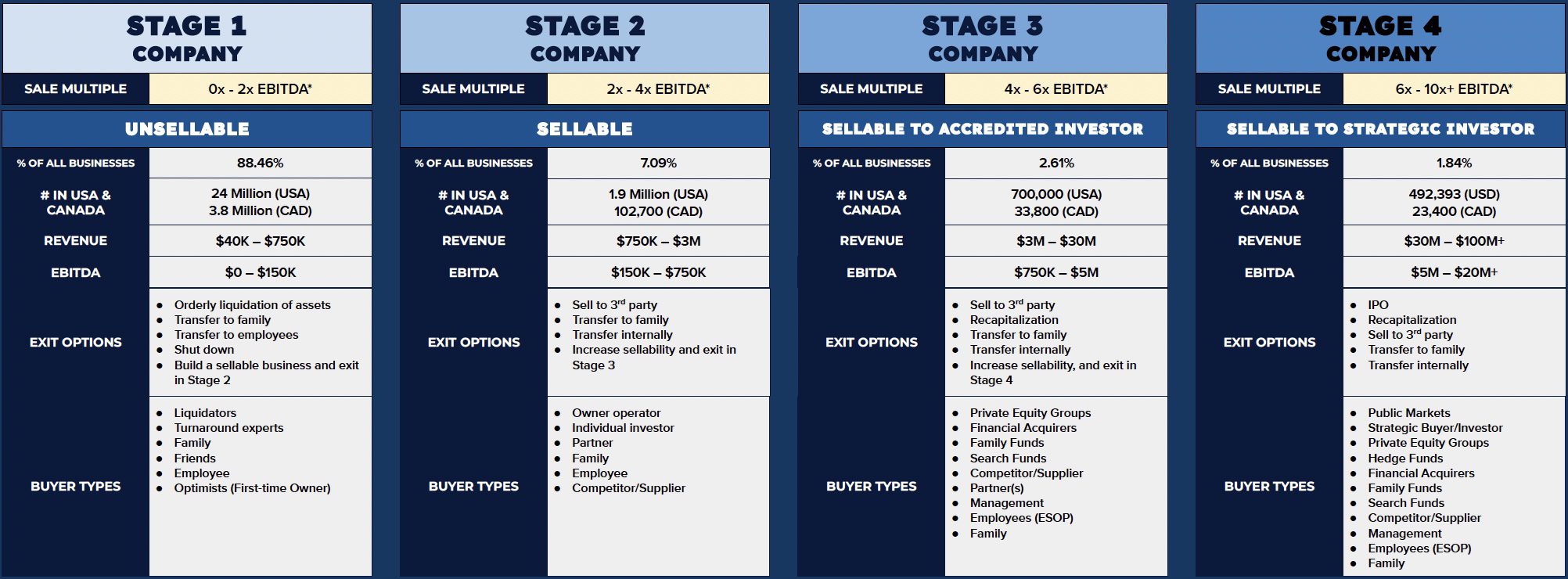

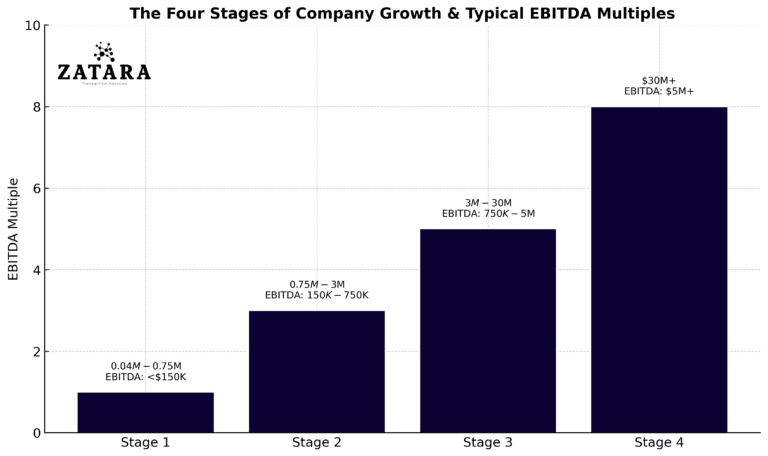

The Four Stages of Company Growth

The Four Stages of Sellability

-

Stage 1: Up to $750K in revenue

- Usually generating < $150K in EBITDA.

- Businesses here typically sell for just 0–2× EBITDA, if at all.

- Buyers? Mostly liquidators, family, employees, or optimistic first-time owners.

- Many owners at this stage simply close shop or hand things off to family.

-

Stage 2: $750K to $3M in revenue

- EBITDA between $150K–$750K.

- Now you’re in the 2–4× EBITDA range.

- Attracts owner-operators, individual investors, competitors, and suppliers.

- You have options: sell, transfer internally, or continue building toward Stage 3.

-

Stage 3: $3M to $30M in revenue

- EBITDA jumps to $750K–$5M.

- Valuations typically land at 4–6 times EBITDA.

- Only about 2.6% of businesses reach this level, making it a sweet spot for private equity, search funds, and strategic acquirers.

- Plenty of exit flexibility here—full sale, recapitalization, partial buyouts.

-

Stage 4: $30M+ in revenue

- EBITDA north of $5M.

- These companies command 6–10 times EBITDA or higher, with buyers ranging from public markets to major strategic buyers and institutional funds.

- Fewer than 2% of businesses ever get here—but those that do often secure life-changing exits.

The Hard Truth

Most small businesses never get past Stage 1 for three core reasons:

1.They aren’t doing enough revenue.

There’s a marketing or sales problem — they’re not generating enough leads, not converting them well, or not fulfilling at scale.

2.They’re not efficient enough.

Either costs are too high (paying too much for rent, suppliers, bloated operations) or margins are too thin to produce meaningful EBITDA.

3.They carry too much risk.

Everything depends on the owner or a few key people. Or financials are messy, contracts aren’t solid, and buyers get spooked.

If you think of the typical Value Acceleration Curve (VAC), it comes down to size, efficiency, and risk. Size and efficiency drive EBITDA. Get those wrong, and your business simply won’t be attractive to buyers or banks.

Many owners end up hoping a buyer will pay to fund their retirement — when the truth is, the business was never built to support it.

How To Move Up the Ladder

There are two main paths:

- Grow internally: Tighten operations, raise prices to protect margins, and build a management team so the business can run without you.

- Grow externally: Acquire smaller businesses. Bundle two Stage 1s to hit Stage 2 metrics, or five to leap into Stage 3. The buyer pool and multiples expand dramatically as you move up.

Why This Matters

A business stuck in Stage 1 is often just “buying a job,” which is tough to sell. By contrast, once you cross the $150K EBITDA line, you start opening real doors—and by Stage 3, you’re on private equity’s radar.

If you want a clear look at where you stand today (and how to boost your valuation), start with a Market Value Assessment. From there, we can build a Value Enhancement Plan to move your business up the stages—and position you for a serious payday when it’s time to exit.

I’ll be unpacking each stage in more depth over the next few posts. If you want to talk about where your business sits today or how to make it more attractive to serious buyers, let’s have a conversation.

— Raphael Benesh![]()

Raphael is the founder of Zatara Transaction Advisors, where he helps business owners buy, sell, and value companies with confidence. With years of experience in M&A and a passion for entrepreneurship, he brings clarity and strategic insight to every deal. His data-driven approach and practical advice have made him a trusted guide for owners navigating complex transitions.